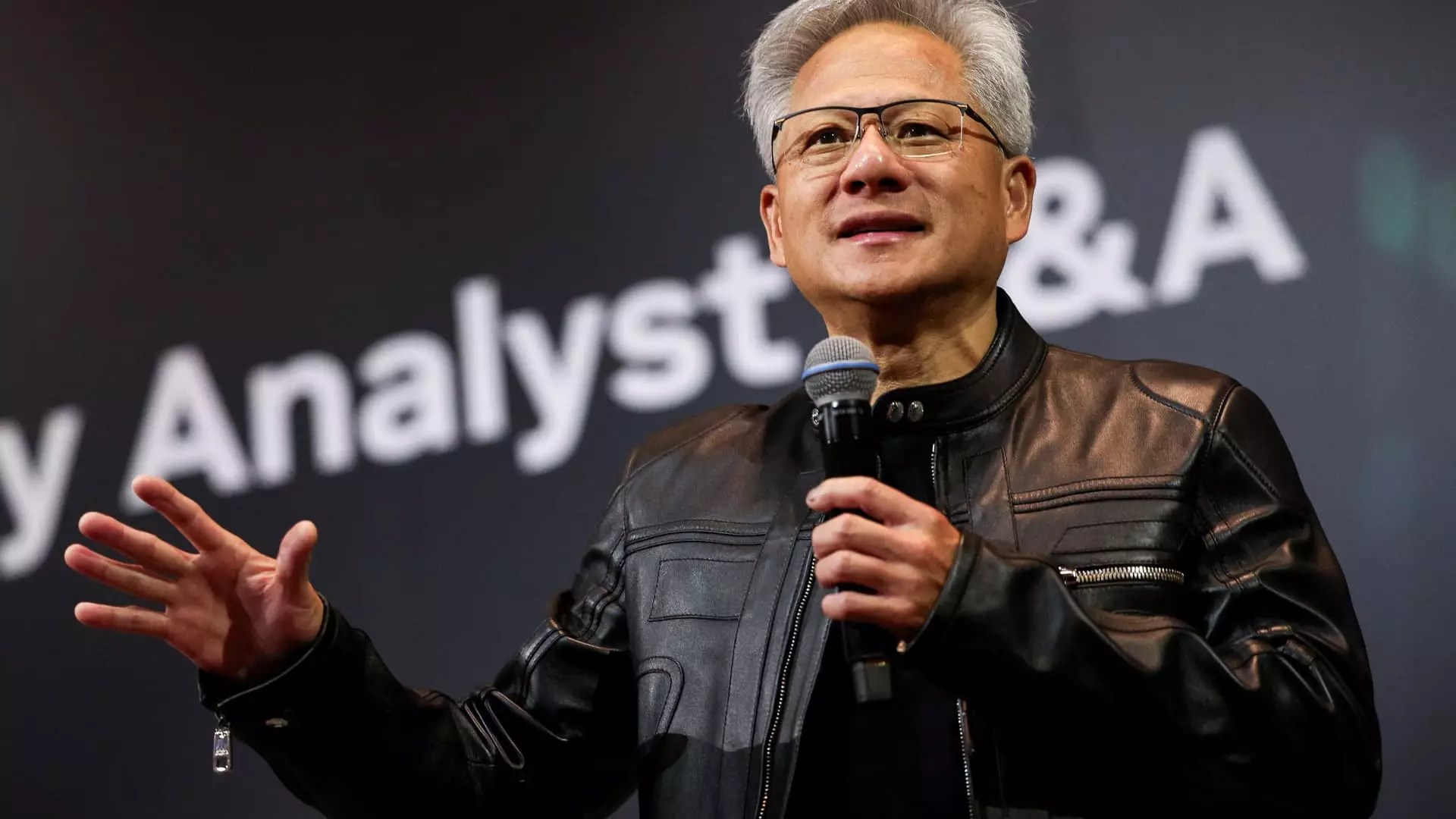

Jensen Huang’s recent sales of Nvidia shares raise more questions than answers about the current state of the AI industry and the company’s trajectory. While the CEO’s stock sales are officially structured under a pre-approved trading plan, the scale of these transactions—totaling over $50 million within a short span—suggests a calculated move rather than mere portfolio diversification. This pattern illuminates a potential shift in confidence from the top leadership amid a surge in market valuation that has arguably detached Nvidia from its fundamental economic indicators. The trillion-dollar valuation, driven by AI hype, risks fueling a bubble that could burst when the realities of sustained demand and geopolitical tensions collide.

Market Excitement vs. Fundamental Risks

Despite Nvidia’s rapid rise, with its market cap exceeding $4 trillion, questions persist about the sustainability of this growth. The company’s massive valuation appears to be disproportionately inflated by speculative enthusiasm for AI and graphics processing units, particularly in the face of escalating geopolitical complications. The U.S. government’s cautious approach towards export licenses to China underscores the fragility of Nvidia’s international ambitions. The reintroduction of sales for its H20 chips to China, after regulatory delays, hints at ongoing geopolitical tug-of-war threatening the company’s expansion plans. This tug-of-war highlights an underlying vulnerability—companies like Nvidia relying heavily on geopolitical goodwill, which can evaporate overnight.

Leadership’s Signal: Confidence or Caution?

Jensen Huang’s decision to offload a significant portion of his holdings might be interpreted in many ways. Skeptics argue it signals a lack of confidence in Nvidia’s ability to sustain its current growth rate, especially given the volatile global political climate. Others contend it’s a savvy move, anchoring a portion of his wealth amidst a market that may be overheating and preparing for a downturn. His remarks about being eager to sell more advanced chips to China reveal an underlying ambition to maintain global leadership, but it also exposes the sector’s deep dependence on regulatory approval, which remains unpredictable at best.

Implications for the Broader Tech Ecosystem

The combination of massive stock sales by executives and ongoing geopolitical uncertainties serve as a cautionary tale for investors. The tech industry’s obsession with AI’s potential is blinding many to the inherent risks—overvaluation, regulatory crackdowns, and geopolitical hostility could turn explosive. As Nvidia attempts to navigate these waters, its leadership’s decisions will undoubtedly influence broader industry sentiments. The question remains whether this rapid ascent is driven by genuine innovation or inflated expectations, and whether the leadership’s secret sales are a sign of trouble brewing beneath the surface.

Final Reflection: A Reckoning on the Horizon?

In a landscape dominated by hype and geopolitical meddling, Nvidia’s current trajectories—boosted by CEO stock sales and regulatory hurdles—pose a stark reminder: greatness in technology is fleeting without sustainable fundamentals. The center-right liberal perspective suggests that responsible leadership requires balancing innovation with prudence, and safeguarding national interests while fostering global competitiveness. Huang’s liquidity moves, while legal, hint at a more complex reality where optimism may be wilting, and the sector needs a dose of realism rather than relentless speculation. In the end, the true test lies ahead: can Nvidia and the broader AI industry maintain their sky-high valuations without relying on endless government favors or investor complacency?